ETH Price Prediction: Navigating the $4,000 Support Battle

#ETH

- Technical Strength: MACD shows robust bullish momentum despite price correction

- Critical Support: $3,700-$4,000 range serves as make-or-break level for medium-term trend

- Fundamental Backing: Institutional adoption continues with SWIFT partnership offsetting ETF outflow concerns

ETH Price Prediction

ETH Technical Analysis: Key Levels to Watch

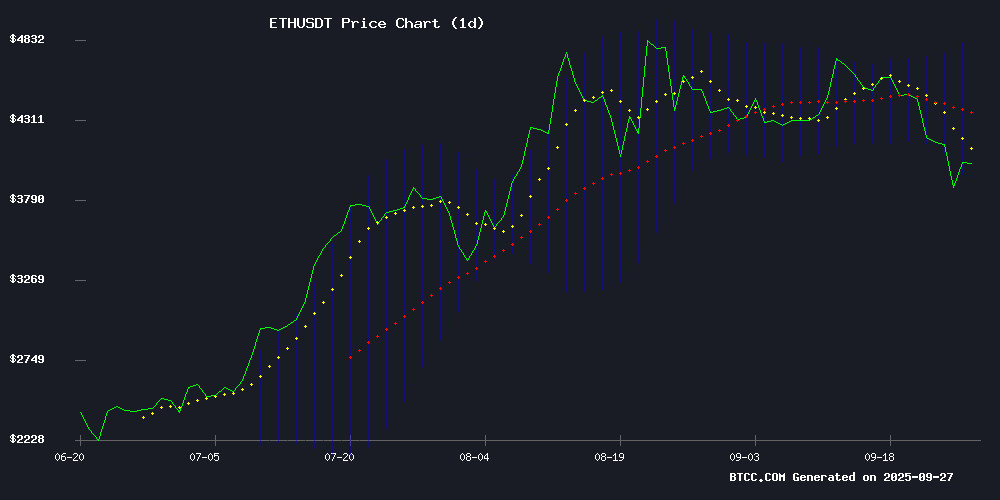

According to BTCC financial analyst Robert, Ethereum's current price of $4,019.95 sits below the 20-day moving average of $4,372.38, indicating potential short-term weakness. However, the MACD reading of 152.01 versus 26.95 shows strong bullish momentum remains intact. The Bollinger Bands position ETH between support at $3,916.04 and resistance at $4,828.73, with the current price testing the lower band which could signal a buying opportunity if support holds.

Market Sentiment: Mixed Signals Amid Regulatory Developments

BTCC financial analyst Robert notes that while ETF outflows and regulatory pressures create headwinds, positive developments like SWIFT's partnership with Ethereum's Linea and strong technical support at $4,000 provide counterbalancing optimism. The market appears trapped between institutional caution and fundamental growth potential, with the $3,700-$4,000 range serving as a critical battleground for medium-term direction.

Factors Influencing ETH's Price

Ether ETFs See Record Outflows as ETH Price Drops 10% Amid Staking Uncertainty

US-listed spot Ether ETFs recorded five consecutive days of net outflows totaling $795.8 million, the largest weekly withdrawal since September. Ether's price fell roughly 10% during the period, testing support near $3,750 as retail investors retreated.

Market attention focuses on Grayscale's preparations to stake 40,000 ETH from its $1.5 billion holdings - a move interpreted as confidence in eventual SEC approval for staking in ETFs. The potential regulatory green light could reverse recent bearish sentiment that crypto analyst Bitbull describes as 'capitulation.'

Ether's performance contrasts with broader crypto market trends, where institutional products typically lead retail flows. The prolonged outflow streak suggests particular weakness in ETH-specific demand drivers despite the staking catalyst waiting in the wings.

SWIFT Partners with Ethereum's Linea for Blockchain Messaging Pilot

SWIFT, the global financial messaging network, is reportedly collaborating with Ethereum-based Linea to test blockchain integration for interbank communications. More than a dozen major institutions including BNP Paribas and BNY Mellon are participating in what one bank executive describes as "a major technological transformation" for cross-border payments.

The pilot leverages Linea's zero-knowledge proof technology, enabling banks to experiment with blockchain features while maintaining strict privacy controls. This addresses longstanding institutional concerns about public ledger transparency. The multi-month test could fundamentally reshape correspondent banking by combining payment messaging and settlement into single blockchain transactions.

Currently, SWIFT's 11,000-member network only transmits payment instructions, relying on legacy systems for actual fund movement. The Linea integration aims to enable real-time payment tracking while reducing intermediary costs and processing times. Success could accelerate institutional adoption of Ethereum-based solutions for wholesale finance.

Ethereum (ETH) Price Prediction: ETH Flips $4K Into Support as Short Squeeze Fuels Bullish Momentum Toward $7K

Ethereum has reclaimed the $4,000 threshold, transforming a historic resistance level into support amid a broader market recovery. The asset now trades at $4,011.84, marking a 0.69% daily gain following a week of extreme volatility that wiped billions from derivatives markets.

Market analysts highlight the psychological significance of this technical flip. "A bullish retest is never a bad thing during a bull run," observes crypto analyst Cas Abbé, noting Ethereum's rare achievement. Academic research suggests only 3% of assets successfully convert major resistance into support during uptrends.

Whale accumulation patterns and institutional flows near the $4,000 level suggest growing conviction. The next resistance zone appears near $7,000, though sustained momentum will require holding this newly established support floor through future retests.

Ethereum Dips Below $4,000 Amid Macro and Crypto-Specific Pressures

Ethereum fell below the $4,000 threshold for the first time since August 8, as a confluence of macroeconomic headwinds and crypto-market dynamics triggered a broad selloff. The drop reflects mounting caution among traders, with leveraged positions unwinding and regulatory uncertainty lingering.

A resurgent US dollar and the Federal Reserve's tempered stance after its September rate cut have sapped appetite for risk assets. Rising Treasury yields and political brinkmanship over a potential government shutdown further diverted capital from cryptocurrencies.

The selloff accelerated as over $500 million in ETH long positions were liquidated within 24 hours, including $45 million worth of whale holdings. Such forced selling exacerbated downward momentum, highlighting the perils of excessive leverage in volatile crypto markets.

Ethereum’s Road to $6000: $3,700 Test in Q4 2025 Pivotal for Rally

Ethereum approaches Q4 2025 at a critical juncture, with the $3,700 level emerging as a decisive battleground for bulls. A successful defense of this support could catalyze a march toward $6,000, fueled by institutional inflows and expanding Layer 2 adoption. Failure risks prolonging consolidation.

Current price action shows ETH struggling to maintain momentum above $4,200 after breaking through $3,876 earlier this quarter. Liquidity heatmaps reveal concentrated interest around $4,000, suggesting this psychological threshold may determine near-term direction.

Market participants remain divided. Some view the pullback as a buying opportunity ahead of anticipated ETF approvals and protocol upgrades, while others caution that macroeconomic headwinds could delay Ethereum's breakout narrative.

Vitalik Buterin Opposes EU's 'Chat Control' Bill, Citing Threats to Digital Privacy

Ethereum co-founder Vitalik Buterin has launched a scathing critique of the European Union's proposed 'Chat Control' legislation, framing it as a fundamental assault on digital privacy. The bill, which mandates backdoor access to encrypted communications, draws parallels to broader tensions between state surveillance and individual freedoms in the digital age.

Buterin's intervention cuts through diplomatic niceties. His argument rests on technical inevitability: deliberately weakened encryption creates systemic vulnerabilities. This stance resonates with crypto-native principles where privacy-preserving technologies like zero-knowledge proofs are gaining traction as antidotes to surveillance overreach.

The controversy exposes a growing rift between Web3 ideology and traditional governance models. As lawmakers pursue expanded monitoring capabilities, decentralized networks increasingly position themselves as architectural countermeasures - with Ethereum's ecosystem at the forefront of this ideological battleground.

Can Ethereum (ETH) Price Hold $4,000? Yes, But Only If…

Ethereum's price dipped 10% this week, testing critical support at $4,021—a level coinciding with its 200-day moving average. Technical indicators flashed oversold signals, with the RSI at 33 and Williams %R near -80, historically precursors to rebounds. Market-wide liquidity constraints and U.S. regulatory tensions added pressure, yet ETH's foundational role in DeFi and smart contracts sustains investor interest at this threshold.

Analysts note the $4,000 zone has repeatedly acted as a springboard for rallies, but current conditions demand caution. The token's fate hinges on broader market sentiment and its ability to maintain this psychological support level amid fluctuating demand.

Ethereum Retests $4K Support Amid Record ETF Outflows

Ethereum's price plunged to $4,000, retesting a critical support level after two consecutive weeks of declines. The drop coincides with a record $795 million outflow from U.S.-listed ETH ETFs—the largest weekly redemption since early September's $787 million exodus.

Institutional demand shows signs of waning despite $26 billion remaining parked in Ethereum funds, representing 5.37% of total supply. The asset remains up 190% from April's $1,377 low but has retreated 18.7% from its 2024 peak of $4,920.

Market dynamics reveal a sharp reversal: recent outflows erased September's $556 million and $637 million inflows, signaling cooling institutional appetite. Liquidations accelerated as ETH's price action mirrored the ETF capital flight.

Ethereum Grapples with On-Chain Scams as Retail Sentiment Wanes

Ethereum, the dominant smart contract platform, faces mounting criticism amid a surge in fraudulent activities disrupting its ecosystem. While the network's security remains intact, malicious projects are exploiting vulnerabilities, triggering what analysts describe as an "on-chain bloodbath" and eroding retail investor confidence.

Decentralized applications on Ethereum have seen a spike in rug pulls and scams in recent months, draining liquidity and fostering skepticism among retail participants. Crypto analyst Fat Tony highlighted the contrast between credible projects like Book of Ethereum (BOOE)—which prioritizes organic growth and transparency—and fraudulent ventures that rely on paid influencer marketing to artificially inflate interest.

The proliferation of scams raises questions about Ethereum's ability to retain its status as the cornerstone of DeFi innovation. Once hailed as the birthplace of decentralized finance, the network now contends with a credibility crisis that could reshape its trajectory.

Lyno AI Tops 2025 Presale Rankings with Cross-Chain AI Arbitrage System

Lyno AI has emerged as the standout presale project of 2025, commanding analyst attention with its AI-powered cross-chain arbitrage protocol. The platform's Early Bird phase offers tokens at $0.050—a 9% discount to the upcoming $0.055 price tier—with 793,580 tokens already sold and $40,000 raised. Its neural network architecture executes rapid trades across Ethereum, Polygon, and Optimism networks, delivering 2.6% ROI through flash loan strategies that outperform single-chain competitors like Remittix.

Market observers note parallels to Ethereum's 150% surge in 2024, with Lyno AI's multi-chain capability eliminating the whale-sized capital requirements traditionally associated with arbitrage opportunities. The project's community governance model allocates 30% of protocol fees to $LYNO stakers, creating aligned incentives for token holders.

Ethereum Trapped Between Bullish Inflows and Regulatory Pressure

Ethereum faces a turbulent phase marked by conflicting forces. A surge of optimistic investments clashes with looming regulatory uncertainties, leaving traders in suspense. The cryptocurrency currently trades between $4,360 and $4,607, attempting to recover from a 14% weekly drop. Despite recent setbacks, its six-month gain of over 115% underscores strong growth potential.

Key resistance levels loom at $4,764 and $5,011—breaching these could trigger an 11-16% rally. Support levels provide a safety net, but market sentiment remains cautiously optimistic. Traders await clarity as technical signals and regulatory developments dictate Ethereum's next move.

Is ETH a good investment?

Based on current technical and fundamental analysis, ETH presents a compelling investment case with calculated risk. The cryptocurrency demonstrates strong underlying momentum despite recent price pressure.

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | $4,019.95 vs $4,372.38 | Oversold potential |

| MACD Momentum | 152.01 (Bullish) | Strong upward trend |

| Bollinger Band Position | Near lower band | Possible rebound zone |

| Key Support Level | $3,700-$4,000 | Critical holding area |

Robert emphasizes that while short-term volatility exists due to ETF flows and regulatory uncertainty, Ethereum's strong fundamentals and technological adoption provide solid long-term prospects. Investors should consider dollar-cost averaging and maintain a horizon of 6-12 months for optimal results.